Forgivable coronavirus loans offered to Virginia small businesses by nonprofit startup

Wexton discusses small business issues amid coronavirus crisis

Virginia Congresswoman Jennifer Wexton discusses small business issues facing the region amid the coronavirus crisis.

FOX BUSINESS - As the coronavirus continues to spread throughout the U.S., small businesses are struggling to stay afloat after experiencing more than a month of declining demand and the subsequent resistance or sluggish response from large banks when it comes to issuing loans. However, one entrepreneurial couple in Virginia has launched a nonprofit loan company to aid small business owners in need of support.

Download the FOX 5 DC News App for Local Breaking News and Weather

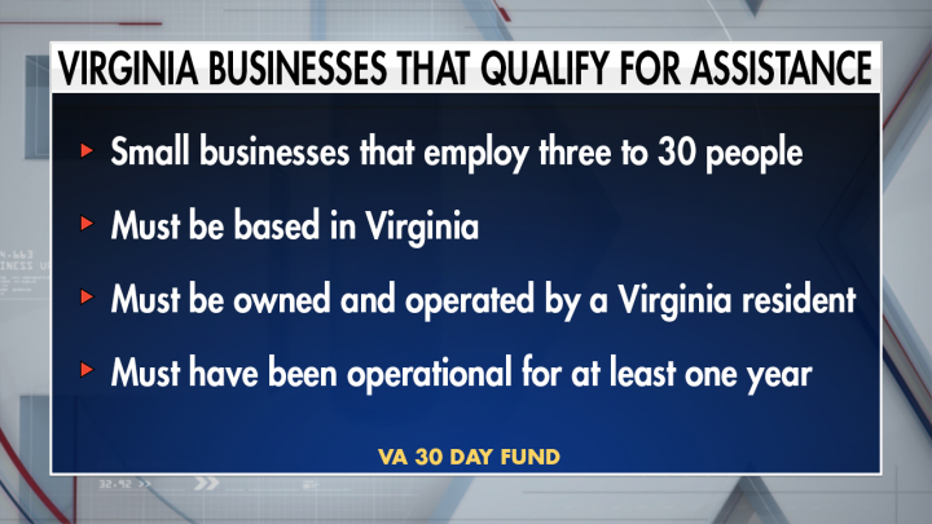

The VA 30 Day Fund launched in the second week of April under Pete and Burson Snyder, who put up $100,000 of their own money to get the fund up and running. Small businesses that apply for a loan with VA 30 can receive up to $3,000 if they are approved, and better yet, the loans are forgivable in case COVID-19 makes it impossible to fully recover.

On its first day of operation, Pete Snyder of VA 30 told FOX Business the company received more than 120 applications.

“This was 10 times worse than I ever thought. And it's not just the local bar and restaurant or nail salon,” he explained. “It's your fairly affluent dentists who may have kids in private school and six different locations and maybe had to fire 95 percent of his people because he never knows when he's going to practice again. This virus and economic carnage knows no bounds.”

CORONAVIRUS RESOURCES: Everything You Need to Know

When it comes to why the Snyders felt moved to help local small businesses and take on the risk themselves, the timing of financial relief was a critical factor.

“I think the administration has done a great job of getting $2 trillion out there. We just felt from a private sector perspective, it can work more quickly,” Snyder shared. “People need help now and that's why we started to do it.”

So far, VA 30 has helped over 60 small businesses across the state of Virginia with direct money transfers in the age of social distancing. The businesses that receive the loans can pay the funds back if they are in a position to do so, according to Snyder.

“Entrepreneurs usually don't like handouts, but they might need a lifeline,” he added. “We set this up so there's a clause that if it's in six months or nine months or whatever if they're back on their feet and doing well and they can pay back the three grand so that we can help another at-risk business that's in there.”

CORONAVIRUS IN DC, MARYLAND AND VIRGINIA

Applicants who reach out to the VA 30 Day Fund are required to submit a short video, which can be filmed on a camera-enabled smartphone or similar device. The 90-second to three-minute clips are an opportunity for applicants to share where they will use the money.

The number one thing small business owners have told VA 30 they’re concerned about is payroll. According to Snyder, most are fighting hard to “keep an extra person or so onboard for an extra month instead of having to get rid of them or put them on unemployment.” The other two areas small businesses have reached out to VA 30 for involve rent and health care for employees.

“This has been the most rewarding and significant thing that I've ever done,” Snyder said. “It's heart-wrenching sometimes, but we're really making a difference and we're just getting started."

With the increasing demand for financial relief among small businesses, the VA 30 Day Fund is open to donors who wish to help fund the forgivable loans.

“We should be out of business in 30 to 45 days. Our whole mission is to get people over the hump until the federal cavalry gets there,” Snyder added. “Or at least I hope that’s the case, but that might not be the case. We might have to be here for 90 days or 120 days. I'm just not quite sure. It's all a matter of when can people get back to work.”