Report: DC is the worst state at managing money, Maryland falls in second place

FOX BUSINESS - If you live in South Dakota, chances are high that you’re a savvy saver.

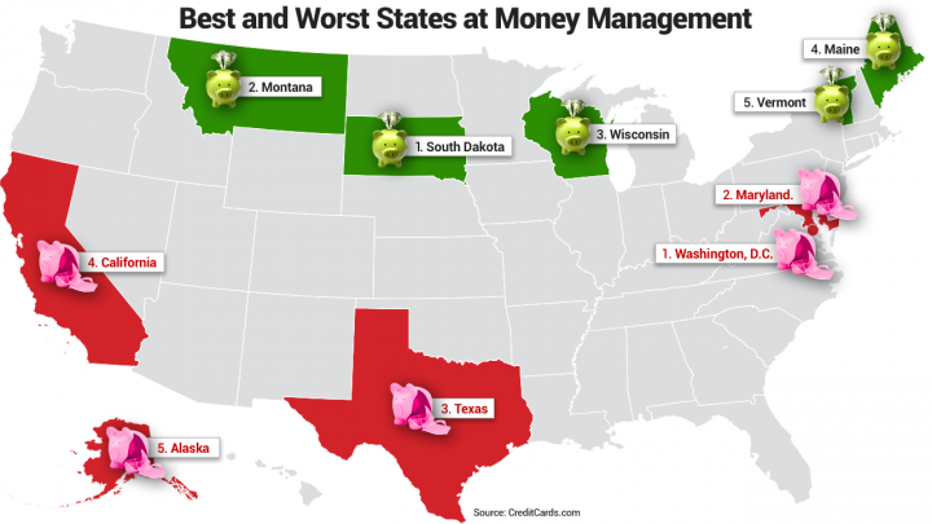

The Mount Rushmore state nabbed the top spot of all 50 states based on a money-management score, according to a new study from CreditCards.com. It was followed by Montana, Wisconsin, Maine and Vermont.

The study, which was based on median income and average credit scores, found that states with higher incomes don’t necessarily have higher credit scores. Even though South Dakota’s median household income is only $56,274, well below the national average, its average credit score -- 727 -- tied for the second highest.

“You can build a solid credit score wherever you live, yet this data suggests it’s easier in some places than others,” said Ted Rossman, industry analyst at CreditCards.com. “What’s surprising is that many of the highest-income states underperform in the credit score category. A high cost of living and lifestyle creep often combine to drag credit scores down.”

Montana, Wisconsin, Maine and Vermont also had either middle-of-the-pack or lower median incomes but solid credit scores, suggesting a “high level of fiscal responsibility among those states’ residents.”

On the other end of the spectrum, states with high incomes tended to lag behind the others in terms of credit scores. Washington, D.C., ranked as the worst at managing money, with the highest median household income in the country at $85,203, but a below-average credit score of 703.

A similar trend occurred in Maryland, which placed second to last in the money management ranking.

Texas, which has one of the worst average credit scores in the country at 680, placed as the third worst, despite a solid median income of $60,629. California and Alaska rounded out the worst five.

For story updates visit www.foxnews.com.